این اتفاق چند سال پیش با ورود محصولات چینی به بازار مشاهده شده بود و شباهت های بین بیلت ایران و چین فراتر از قیمت های رقابتی است اما آیا ایران هم می تواند در منطقه تسلط پیدا کند؟

در چند ماه گذشته معاملات مربوط به بیلت ایران در آسیای جنوب شرقی که بزرگترین منطقه برای واردات محصولات نیمه نهایی فولاد است، ۱۰ تا ۱۵ دلار در هر… کاهش یافته است. تا همین اواخر تایلند تنها کشوری بود که به طور منظم از ایران در این بخش واردات انجام می داد اما قیمت پایین این محصول در کشورهای خاورمیانه، خریداران سایر کشورها نظیر مالزی و اندونزی را به خرید متمایل کرده است.

خریداران جنوب شرقی آسیا می گویند، تامین بیلت با این قیمت ها تاکنون نادیده گرفته شده بود.

این مسئله به طرز شگفت انگیزی شباهت به بیلت چین داشت که در اولین بار در سال ۲۰۱۳ مورد توجه تعداد شماری از واردکنندگان فیلیپینی قرار گرفت و در آغاز سال ۲۰۱۴ به کل منطقه گسترش یافت و نظر واردکنندگان مناطقی از قبیل کره جنوبی، روسیه و دیگر کشورها را به خود جلب کرد.

ایران هیچ گونه محدودیتی در صادرات یا واردات تجاری ندارد. با این حال سیستم بانکی معضلی است که بسیار مهم است و تقریبا دور زدن آن غیر ممکن است.

باوجودی که حدود یک سال و نیم (یعنی از ژانویه ۲۰۱۶) از زمان معاهده هسته ای ایران و شورای امنیت سازمان ملل و اتحادیه اروپا (برجام) می گذرد اما شاهد هستیم که هنوز تمام تحریم های تجاری علیه ایران لغو نشده است.

تحریم ها عمدتا از سوی آمریکا هنوز باقی مانده و این بدان معنی است که شرکت ها و افراد نمی توانند در معاملات دلاری با همتایان خود شرکت کنند زیرا معاملات باید از طریق سیستم بانکی آمریکا انجام شود. برخی کارشناسان معتقدند، تجارت با ایران به تدریج باز می شود البته نباید فراموش کرد، با وجود فرصت های عظیم سرمایه گذاری در ایران، بانک ها و بیمه ها هنوز هم مرددند. با این حال بسیاری از کارآفرینان و تجار منطقه ای علاقمندند فرصت های تجاری با ایران را بررسی نمایند.

علی رغم باقی ماندن تحریم های آمریکا، برخی تجار در بازارهای آسیایی به ویژه آسیای جنوب شرقی در تلاشند تا بدانند چطور می توان امکان تجارت با ایران را فراهم کرد.

FOCUS: Is Iran the new China for steel billet?

Iranian steel billet has been quietly gaining market acceptance in Southeast Asia because of its low prices, just as it happened with China-origin product a few years ago, but can it dominate the region?

In the past several months, transactions involving Iranian billet had been concluded on and off in Southeast Asia – the world’s largest import region for the semi-finished steel product – at $10-15 per tonne below prices of cargoes of other origin.

Until recently, Thailand was the only country that regularly imported billet from Iran in this part of the world.

But the low prices of cargoes from the Middle Eastern country have piqued the interest of buyers in places such as Malaysia and Indonesia.

“It’s just too cheap to ignore,” one buyer source in Southeast Asia told Metal Bulletin.

This is strikingly similar to the story of Chinese billet, which first attracted the attention of a handful of importers in the Philippines around the end of 2013 and beginning of 2014 before spreading to the entire region, displacing shipments from South Korea, Russia and other countries in the process.

Loopholes

The similarities between Chinese and Iranian billet go beyond just competitive prices.

In both cases, trade has been based on loopholes.

In the case of China, the workaround is well known to the market: billet is typically declared as alloy square bars by Chinese mills and trading companies, with the intention of both avoiding a 25% export duty on semi-finished carbon steel and claiming a 13% export tax rebate.

Iran has no customs restrictions whatsoever on either the export or import side of the business. The hurdle it faces lies in a crucial area that is almost impossible to bypass: the banking system.

Even though it has been already one-and-a-half years since Iran’s nuclear deal with the United Nations Security Council and the EU came into force in January 2016, not all of the trade sanctions against it have been lifted so far.

Crucially, domestic sanctions in the USA remain in force, which means companies or individuals cannot engage in US-dollar transactions with Iranian counterparts as such deals must pass through the US banking system, a top lawyer explained last year.

“Trade is gradually opening up. There are massive opportunities in Iran, but banks and insurers are still very nervous,” Anthony Woolich, a partner at London-based law firm Holman Fenwick Willan, said at a seminar in Singaporethat attracted many regional traders and entrepreneurs interested in exploring commercial opportunities with Iran.

But despite the US sanctions, deals are still being concluded, and many market participants across Southeast Asia have been scratching their heads as they try to understand how this was possible.

So how does it work?

“Well, if it was easy, everyone would be doing it,” one trader who deals in Iranian billet laughingly said recently when asked by Metal Bulletin.

There are many details about payment and financing terms, and there are considerable difficulties when it comes to closing a deal, he said.

But basically, two ways have worked so far in Southeast Asia.

Trading firms – especially a few companies based in Dubai as well as in European countries such as Germany and Austria – take the bigger risk as they are the ones buying directly from Iranian mills. They usually take care of advanced payments of 10-20% of the total value of the contract, the trader said.

In some cases, Iranian mills may ask for as much as 30% of down payment before concluding an export sale, a second trading source with knowledge of such transactions said.

Buyers in Southeast Asia can then either open a letter of credit (L/C) in euros or, preferably, make a telegraphic transfer (T/T) in euros to the trading company.

Other currencies, such as the pound, yen or even the UAE’s dirham, could also be accepted depending on the trading company involved.

Opening L/Cs is a bit riskier as it involves more scrutiny from the banks.

But on the other hand, most buyers in the region either do not have the financial capability to make direct payments via T/Ts, or simply do not like to do so, several market participants told Metal Bulletin.

“For a direct [telegraphic] transfer, you need to have a lot of cash in your bank account – and this is not the case with many of the buyers in this region,” a third trading source in Southeast Asia said.

After the shipment is made, a bill of lading (B/L) is sent to the buyer, who then needs to pay the remaining value. The balance can be also paid upon receipt of the cargo, depending on the trading company.

No mention

The most crucial element of such transactions is that Iran is never mentioned in the sales contract or the B/L.

The billet cargo is loaded in a vessel in Iran but the ship first goes to a nearby country such as the UAE before it heads to Southeast Asia. The B/L will have either this country or a general “Arabian Gulf” or “Persian Gulf” stated as the origin of the cargo.

In the face of all these hurdles, it is no wonder then that only a few billet buyers in the region have taken the risk of importing from Iran, that is, apart from Thailand, which has been dominated by Iranian supply since early this year.

But more buyers, especially in Indonesia, are warming up to the idea of purchasing Iranian materials.

And even when they do not, they are using Iranian billet as leverage when negotiating prices in Southeast Asia, several sources said.

“Sometimes we put out a very aggressive offer [involving non-Iranian cargoes] but even buyers who are not buying from Iran would not buy from us, saying they got lower offers [for Iranian billet],” a source at an international trading firm said.

In other words, buyers will use the low Iranian prices to squeeze traders and try to get the best lowest deal for non-Iranian product.

Sometimes all it takes is a single buyer booking materials from Iran to make a difference. As the buyer is paying a lower price for the semi-finished product than its competitors, it can afford to sell its finished steel at a discount and eat up the market share.

This will have a domino effect on the market.

Pressured by lower sales of finished steel, other buyers may then turn to Iranian billet too.

Shifting trends

The fact that more Iranian cargoes are making their way to Southeast Asia shows that Iranian steelmakers have jumped on to the export bandwagon ever since the Middle Eastern country opened up to international trade early last year.

The country shipped 5.53 million tonnes of steel products abroad during the Iranian year ended March 20, of which 3.74 million tonnes consisted of semi-finished products.

It aims to increase its steel exports to 8 million tonnes in the current Iranian year, which ends on March 21, 2018.

Meanwhile, China’s steel exports have been sliding on a year-on-year basis since the end of 2016 because of plans to cut capacity being pushed forward by the country’s central government and, more recently, a crackdown on mills that produce substandard steel.

In January-May this year, China exported 34.19 million tonnes of finished steel – a steep fall of 26.1% from 46.28 million tonnes over the same period of last year.

Market participants say billet exports accounted for the biggest drop.

Cat and mouse

While Iran has been exporting less than 5 million tpy of billet, China is widely thought to have shipped as much as 25 million tpy in recent years, the director of a major trading company in Asia said.

In 2015, for instance, China exported way over 4 million tonnes of billet to Southeast Asia, though it is very difficult to ascertain the exact figure since such exports are often declared under several HS codes used for alloy bars.

“So no, I don’t believe Iran will become the new China,” the director told Metal Bulletin.

More worryingly to Iranian mills and traders dealing in exports from the country, the hurdles encountered by two recent cargoes of Iranian semi-finished steel have “scared away” many potential buyers in Southeast Asia, a trading source familiar with this trade flow said.

Th e first case centres around a 40,000-tonne cargo of Iranian slab that has been held in Thailand since March because of a dispute between the importer and the insurer. The case has landed in a Thai court and there is yet to be any word on its outcome in the market.

The second case is taking place a couple of thousand kilometres south of Thailand, in Indonesia.

A cargo initially believed to consist of 40,000 tonnes of Iranian billet, but had actually comprised up to 50,000 tonnes, had arrived at a port in Jakarta last month but was not unloaded. This was because the Indonesian bank had refused to honour the letter of credit (L/C) upon discovering that the cargo had originated in Iran, several sources in and out of Indonesia said.

A search on the Marine Traffic website showed that the vessel – bulk carrier Karaagac – had left Iran at the end of May and was to have berthed in Jakarta in the middle of June but unexpectedly turned back. It stayed just outside the coast of Sri Lanka for several days.

Towards the end of June, the vessel started making its way towards Jakarta again. It is scheduled to arrive in the Indonesian capital in early July, according to the website.

This suggests that the payment issue may have been resolved in the end.

Many market participants in Indonesia, however, are of the opinion that this case could have a major effect on the trading of Iranian steel into the Southeast Asian country.

“There’s always a learning curve,” one of the sources said.

“In May, two [Iranian billet] cargoes arrived in Indonesia, the L/Cs opened in a foreign currency [other than US dollars] went through but maybe this won’t happen anymore.

“Banks are asking more questions,” he went on. “They know what tricks have been played and will make things more difficult from now on.”

A buyer source in the country agreed.

“We can’t take credit from the bank [for transactions involving Iranian products] and insurance is a headache,” he pointed out.

Not everyone shares the same opinion, however.

The secret to avoiding problems is to stick to payment in euros and use banks with no ties to US banks or US companies or shareholders, another one of the sources told Metal Bulletin.

“In the short term, buyers will become more careful, but they will come back,” he said.

“At least now everyone knows what the terms are and buyers can decide [whether] to take the risk or not. If they can pay with T/T in euros or L/C in euros using 100% local banks, in theory, there should be no problem.”

What lies ahead?

While Iranian billet has been sold to countries such as Thailand, Indonesia and Malaysia, there has yet to be any word in the market on deals involving the Philippines, which is the biggest importer of the product in Southeast Asia.

Buyers in the Philippines had been the trend setter when they started importing Chinese billet a few years ago, a move that was adopted by their peers across the region soon after.

Sources in Manila said that many traders had been trying to sell Iranian materials in the country, but Filipino banks had so far refused to get involved with such transactions since most international trade in the country is conducted using US-dollar-denominated L/Cs.

However, the fact that there is no import duty anymore on billet of any origin into the Philippines means there is a higher likelihood of Iranian products eventually finding their way into the country, several sources conceded.

On the sidelines of a recent conference, a Filipino steel industry veteran seemed amused when asked whether Iran could eventually replace China as Southeast Asia’s main billet supplier.

“Well, yes, it could be Iran,” he said. “But it could also be India or another country.”

“It could be Iran, India or maybe even Vietnam,” he went on, noting that Formosa Ha Tinh Steel had just commissioned the first blast furnace of a steelmaking complex that could eventually have more than 20 million tpy of crude steel capacity.

“But did you know that Australia was the largest supplier to the Philippines in the 1970s?” he asked in turn.

Since then, the Philippines and other Southeast Asian countries have seen the rise and fall of other major billet suppliers to the region, such as Russia, Ukraine and, more recently, South Korea, he said with a smile.

In the ever-changing landscape of steel trade flows throughout the years, only one thing is certain, he seemed to suggest: no matter the origin, buyers will continue to buy whatever is available out there.

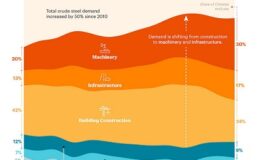

- تغییر الگوی تقاضای فولاد در چین به روایت تصویر

- موانع بزرگ بر سر راه عرضه فولاد در چین/ چینیها این بار منجی بازار جهانی فولاد و سنگ آهن نخواهند بود

- ابلاغیه معاون اقتصادی رییس جمهور در حوزه صادرات

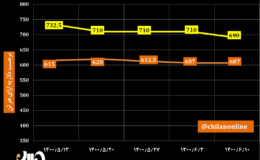

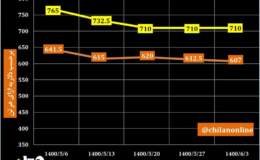

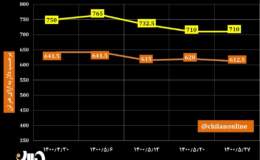

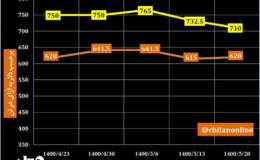

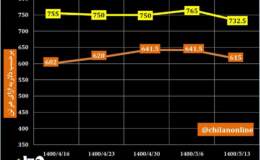

- روند قیمت فولاد صادراتی ایران/ کاهش ۲۰ دلاری قیمت اسلب صادراتی کشور

- روند قیمت فولاد صادراتی ایران/ کاهش قیمتها تحت تأثیر روند نزولی بازار جهانی فولاد

- تخمین اشتباه انجمن جهانی فولاد از میزان تولید فولاد خام ایران در ماه ژوئیه/ جزئیات تولید فولاد جهان در ۷ ماهه نخست سال ۲۰۲۱

- روند قیمت فولاد صادراتی ایران/ کاهش قیمت شمش فولادی و سنگ آهن + نمودار

- روند قیمت فولاد صادراتی ایران/ بازار فولاد زیر سایه فشارهای دولت چین و موج جدید همهگیری کرونا

- روند قیمت فولاد صادراتی ایران/ کاهش بیش از ۴ درصد نرخ شمش و اسلب صادراتی + نمودار

Warning: count(): Parameter must be an array or an object that implements Countable in /home/chilanon/public_html/wp-content/themes/chilan/class/template/WPTemplate.php on line 1984

محمدکاظم صباغی هرندی

مدیر ارشد خدمات فنی و پشتیبانی شرکت فولاد مبارکه

مهندس طهمورث جوانبخت

مدیرعامل شرکت مجتمع فولاد خراسان

عطاالله معروفخانی

مدیرعامل شرکت فولاد هرمزگان

اکبرگلبو

مدیرعامل شرکت بینالمللی مهندسی سیستمها و اتوماسیون(ایریسا)

اردشیر فاضلی

مدیرعامل شرکت بازرگانی معادن و صنایع معدنی ایران (ایمیکو)